From launch to over $1 MILLION DOLLARS in raised investments using Facebook Ads

While established since the 1980’s, this artisanal mezcal company is taking a leap into global expansion in a high-growth market segment.

So when last summer they asked us to drive investments for their Title III regulation crowdfunding campaign on Start Engine, we immediately got to work to outline, test and validate a strategy that could be profitable from day one. And we could only achieve this with a systematic approach to quickly isolate:

The exact combination of audiences that would be most likely to invest: customers were fundamentally different in intent and behavior from potential investors.

Messaging that would resonate with these audiences and persuade potential investors while staying compliant.

Creative and call-to-action combinations that would convert investors in the shortest amount of steps.

Once these steps were in place, the first goal was to redirect quality traffic in order to build enough retargeting volume later on.

Crowdfunding after all is just another facet of eCommerce.

Potential customers would consider an offer; if interested in the offer, they would click on our Facebook Ad to “Learn More”; some of these visitors would show intent to invest by clicking “Invest Now” - the equivalent of “Add to Cart”; they would then fill out an application similar to a Checkout page and a portion of these visitors would finalize their investment and trigger a conversion of $250 of higher.

Our job was to build an engaging and persuasive journey that would match desires and interests of the potential investor; and we were successful thanks to a few key ingredients.

The Platform

Your direct response marketing is only as good as your ability to capture and retarget reached audiences; particularly, those that showed some level of intent (click, visited the page, added to cart, subscribed for more info, etc.).

Not all fundraising platforms support Facebook Pixel tracking - Kickstarter is still limited in this regards, while IndieGoGo allows for easy tracking. This campaign was launched on one of the leading Equity Crowdfunding platforms, Start Engine, which allowed us to trace each investment, capture our most engaged audiences, track and measure the journey of potential investors at each step of the funnel.

The Videos

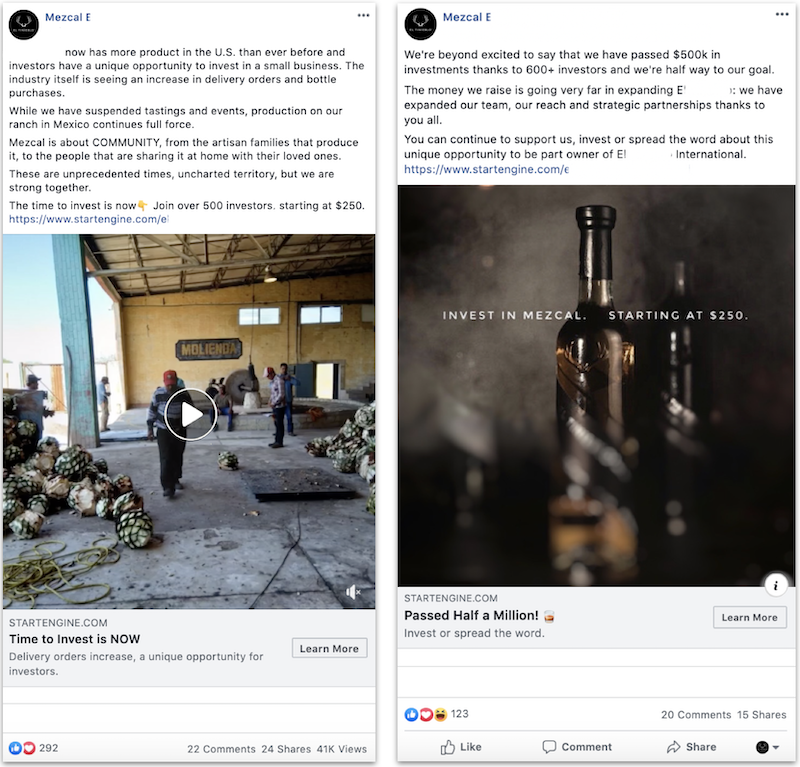

We started with three videos that told the full story, providing potential investors with a powerful narrative that guided them onto the next step. We then repurposed available imagery into slideshows and crafted short videos to multiply available content across different ads and creatives.

The Optimization

Of course a lot of our efforts went into optimizing ad campaigns on a technical level, knowing exactly what funnel structure would drive purchases - in this case investments - at the lowest cost possible. A mix of dynamic and email-based Lookalikes, stacked warm audiences, proper exclusions from our targeting and daily optimization.

The A/B Testing Approach

However, the biggest strength of this campaign has been previously tested, high-converting creative; we didn’t leave these combinations to chance and instead we spent the first week testing multiple variants of videos / copy / headlines / call-to-action buttons. By the end of this process, we had an array of top performing ads at each stage of the funnel.

Month one was a success, with 4.8X Return On Ad Spend (ROAS) and a flood of new potential investors and supporters to propel us into the next stage.

After the initial success, the campaign term was extended as the pool of potential investors became larger and larger with Facebook Ads as the main marketing driver. We continued to scale gradually into the holiday season which is a crucial time as investors unload tax-deductible funds before the end the year and individuals are more giving and supportive.

At the same time, this phase came with its challenges. This is the most competitive time of the year to advertise and ad costs rise up to 40%. Additionally, in order to stay compliant with Equity Crowdfunding regulations, we were often very limited in the messaging we could use. We were not able to incorporate any urgency and scarcity based messaging - ‘campaign is ending soon’ - nor any specific incentive, at a time where the vast majority of direct-to-consumer marketing was blasting 30%-50% discounts and other powerful offers.

Nonetheless, our messaging powered by our scaling strategy paid off, as we generated an astonishing 740% return on ad spend, with peaks of 11.3X ROAS for the whole month of November.

This means that for every $1 spent, they brought in up to $11.3 in investment value, allowing the company to expand their team, distribution, production and strategic partnerships. We then kicked off the new year and transitioned the account to Campaign Budget Optimization (CBO), a new standard that completely changed how budget was allocated across campaigns. We maintained solid performance throughout January reaching 570% return, while updating our creative at every milestone.

When mid February came, we started to see the first signs of a global pandemic affecting performance.

Later on the economy tanked, countries and states across north America started to go on government-issued lockdown and we quickly had to pivot. New messaging had to reflect the current situation, show solidarity and strength, reassure current and future investors.